Just a few days following US President Trump’s tariff announcements, the uncertainty continues for most global business and the impact on day-to-day economics are predicted to be significant. Global stock exchanges have not waited to experience declines unseen since the Covid-19 pandemic. The S&P 500, Nasdaq, and Dow Jones all posted their worst week in over four years during the first week of April 2025. The tech and automotive sectors are already the hardest hits.

Last week, President Donald Trump unveiled a series of tariff measures destined to alleviate the domestic market from the burden of imported products, therefore reprioritizing the consumption of made in US goods, and placing American companies back at the centre of American consumption.

These tariffs came in addition to existing tariff announcements done in March, where Canada, China and steel and aluminium imports were targeted.

What are the tariffs announced:

Universal 10% Tariff on All Imports:

- A baseline 10% tariff will be imposed on all imported goods from every country, effective 5th April, 2025.

On top of these, country specific ‘reciprocal’ tariffs were announced, amongst which:

- China: An additional 34% tariff, resulting in a cumulative 54% tariff when combined with existing duties.

- European Union: An additional 20% tariff.

- Vietnam: An additional 46% tariff.

These country-specific tariffs are set to take effect on 9th April, 2025

Why is this putting the automotive industry under significant pressure

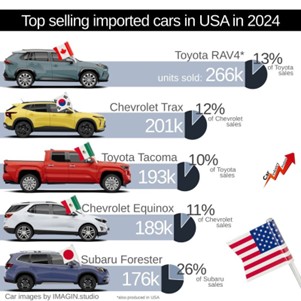

Until now, the United States automotive market has significantly depended on imported vehicles with around 50% of all passenger vehicles sold in the US last year were assembled outside the country.

In 2024, the US imported vehicles for a value of around $200 billion, reflecting the substantial role of automotive imports in global trade.

These figures show how much the US automotive market relies on international manufacturers, and how much economic value these imports weigh on global trade.

Who’s Affected Most?

With this kind of level, it’s easy to understand that many car manufacturers will be involved in the trade of vehicles in the US, and therefore that global players will be impacted.

Indeed, several key countries and their respective manufacturers play significant roles in supplying vehicles to the US:

- Mexico: In 2024, Mexico led as the top exporter of cars to the US, with exports valued at approximately $49.98 billion, accounting for 22.8% of total US car imports.

- Japan & South Korea: Japanese automakers, including Toyota, Honda, Nissan, and Mazda, have a strong presence in the US market. In 2024, Japan’s car exports to the US were valued at $40.76 billion, representing 18.6% of total U.S. car imports. In 2023, South Korea’s car exports to the US accounted for $31.3 billion with brands such as Kia and Hyundai.

- Canada: Canadian exports to the US were valued at $35 billion in 2023, with manufacturers like General Motors, Ford, and Stellantis (formerly Fiat Chrysler) operating plants in Canada that supply the US market

- Germany: German manufacturers such as BMW, Mercedes-Benz, Volkswagen and Volvo are key contributors to US car imports. In 2023, Germany exported vehicles worth $24.3 billion to the US.

Source: Carindustryanalysis, Instagram

Why it matters to Machine Vision players and supply chain:

The automotive industry is one of the top users of machine vision systems. In some markets, automotive accounts for 25–30% of industrial machine vision revenues.

Most common applications of machine vision in the industry include:

Manufacturing automation, with vision for assembly, welding, painting, and inspection.

- Quality control, for surface inspection, defect detection, dimensional accuracy.

- Autonomous driving, with cameras and sensors for Advanced Driver Assistance Sytems (ADAS) and full self-driving systems.

- Logistics, with vision-guided parts picking and warehouse automation.

It is therefore easy to understand that when automotive production or investment slows down, this will have a direct effect on the demand for vision systems, sensors, cameras, and AI software.

Read our article about the use of machine vision in the automotive industry.

The Stacking Effect

The automotive industry was already facing some particular strain since the steel and aluminium tariffs from March was already applying a 25% rate onto imports.

It is one of the largest consumers of steel and aluminium globally. Both are essential to the design, safety, and performance of vehicles. Steel accounts for 50–60% of a typical vehicle’s total weight, as you will find it in chassis and frame, body panels, engine components, suspensions, whilst Advanced High-Strength Steel (AHSS) is increasingly used for safety and weight reduction.

The use of aluminium in cars is growing, especially in electric vehicles and performance/luxury cars, whilst Electric vehicles (EV) will use aluminium for their battery enclosures.

Tariffs on steel and aluminium parts will drive higher material costs, putting a strain on production and profit margins.

Concretely, For imported cars and auto parts, if a product comes from a country facing reciprocal tariffs, then all applicable tariffs will be added to one another:

– Automotive Imports & Components

- ✅ 10% Universal Tariff

→ Applies to all imported goods, including cars and parts. - ✅ 25% Automotive-Specific Tariff

→ Applies to imported cars and auto parts. - ✅ Country-Specific “Reciprocal” Tariff

→ Varies by country:- EU: +20%

- China: +34%

- Vietnam: +46%

→ Stacked on top of the universal 10%.

- ✅ 25% Steel Tariff

→ Applies to raw and semi-finished steel imported into the US, including:- Car frames and structural parts

- Steel components in engines, transmissions, suspensions, etc.

- ✅ 25% Aluminium Tariff

→ Applies to aluminium imports, which hit:- Wheels, panels, and body components

- Battery enclosures and lightweight parts (especially in EVs)

Example: Car imported from Germany (EU = +20% Reciprocal Tariff)

- Base Price at Port: $30,000

- Estimated Steel Content: $2,000

- Estimated Aluminium Content: $1,500

| ✅ Universal Tariff 10% | $ 3,000 |

| ✅ Automotive-Specific Tariff 25% | $ 7,500 |

| ✅ EU Reciprocal Tariff 20% | $ 6,000 |

| ✅ Steel Tariff (on $2,000 steel) 25% | $ 500 |

| ✅ Aluminium Tariff (on $1,500 alu.) 25% | $ 375 |

| Total tariffs | $ 17,375 |

| Final Landed Price: | $ 47,375 |

The final landed price after tariff calculation is in our example a 57.9% increase on the original price at port. It is up to the manufacturer to decided on the best strategy and whether it will absorb the cost or pass it on to consumers.

It’s not over yet: tariffs on semiconductors.

On top of these, posterior tariffs are to be expected on semiconductors next month.

Semiconductors are essential to modern cars. In fact, the average vehicle today contains thousands of semiconductor-based components, and that number is only growing with the rise of EVs, ADAS (Advanced driver-assistance system) and in-vehicle tech.

Semi-conductors are used within the transmission and suspension systems, and play a role in helping the vehicle to adapt to driving environment and conditions. Therefore, you will find semiconductors in gear-shifting technology, for example. Engine control units (ECUs), ADAS features such as lane-keeping assis (LKA). adaptive cruise-control (etc.), or safety systems like ABS, or again infotainment systems also integrate semiconductor chips.

Electric cars use semiconductors for to optimise battery use in their Battery Management System (BMS).

The global automotive semiconductor market was valued at around $67 billion in 2024 and is forecast to exceed $100 billion by 2030, and includes major players such as NXP Semiconductors, Infineon Technologies, Renesas Electronics, STMicroelectronics, Texas Instruments, and Robert Bosch GmbH.

What could the overall potential effects be?

For Foreign Manufacturers

Concretely, car manufacturers importing to the US will face one or several of the following scenarios:

- Negative Impacts on Profit Margin and Demand

With higher tariffs and stacked tariffs, manufacturers will have to either absorb the new costs, therefore reducing their profit margins, or pass the cost on to US consumers with increased retail prices, with the risk of affecting demand.

- Supply Chain Disruption

Many non-U.S. companies are part of multinational supply chains that end in the US Any components or raw materials flowing into the US from abroad will now be more expensive:

- A German auto supplier selling engines to a US plant now faces a 10–25% cost penalty.

- Asian tech firms that ship electronics or components for assembly in the US will be impacted.

This could force companies to restructure their supply chains, relocate some operations, or “onshore” production to avoid tariffs.

- Loss of Market Share in the US

If manufacturers decide to pass on the tariff onto their consumer, US based manufacturers could now have a pricing edge. A shift of demand onto US-based manufacturers, or lower profit margins resulting in a less viable activity, could lead companies to gradually phase out their activity and concentrate on other markets.

- Pressure to Localize Production

To avoid tariffs, foreign firms may shift production into the United States. Nissan for example, has already decided to continue two shifts at its Tennessee plant, reversing a previous plan to reduce shifts, and Stellantis, the owner of several brands such as Chrysler or Jeep, is planning on closing plants in Canada and Mexico. Others could look into investing into Made in USA products.

American cars: the obvious winners?

The Ford F-Series dominated the US market in terms of units sold, with 765,649 units sold last year.

80% of Ford’s vehicles are built domestically in the US. The best-seller F-150 I assembled in Dearborn Michigan, while the Ford Explorer is built at the manufacturer’s Chicago plant. This would put it in a position of strength, compared to foreign manufacturers, however, its supply chain is global, and it imports a significant part of its electrical and electronic components like semiconductors, battery cells, sensors from Asia, including China and Vietnam which are countries particularly hit by the announcements. It also sources parts from Europe and South America.

Ford models, especially its truck and SUV segments, are big users of steel and aluminium in order to produce strong, safe and durable cars on one hand, and lightweight and fuel-efficient on the other. The F-150 pickup’s body, for instance, is one of the most aluminium intensive model in the US market, with 90% of the car-body weight made of military-grade aluminium alloy, and using between 250 and 350 kilos of aluminium per truck

Ford’s response is to leverage their Made in USA position, with a campaign showcasing their ‘commitment’ to the made in America and their investment into the US economy and their role as a job supplier. Its From America, For America program proposes its US-built model to the general public at staff price, in a strategy to increase sales volume and get a competitive edge over others.

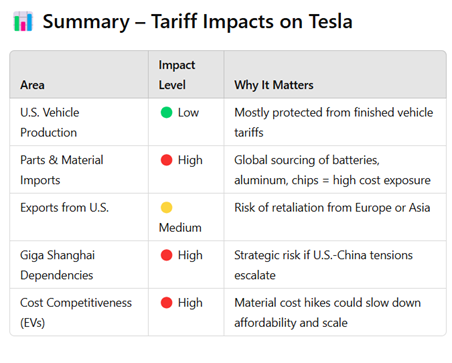

Tesla on top of the world?

One could have expected the tariffs announced to be in favour of Tesla, given CEO Elon Musk’s influence on President Trump and his role in the newly formed DOGE (Department of Government Efficiency).

After being initially quiet about the tariff announcements, Musk has now publicly lashed out on tariff architect Peter Navarro, commenting and reacting to posts more or less direct against the new tariffs. In the past, he had expressed his desire for a US-European tariff free zone to facilitate trade.

Much like Ford, Tesla mainly sells US-assembled cars in the US. They are produced in its original factory of Fremont, California, and its Giga Factory of Austin, Texas. And much like Ford, it also imports components and parts from Asia and other places in the world.

None of its models sold in the US are made in its Giga factories of Shanghai or Berlin-Brandenburg. However, Tesla could face potential retaliatory tariffs on its models S and X, as these are exported from the US to Europe, Asia and other American markets.

Put into perspective, these exports account for a very small percentage of the company’s revenue. Small things, though, could add up and put a spanner in the works for Tesla.

Tesla’s model is that of a balancing act between its global manufacturing strategy and serving local hubs. What needs to be monitored in the coming weeks though is its ability to do so whilst coping with the rising cost of importing raw materials and shipping components and batteries from its Shanghai giga factory.

All in all, although being at first glance less exposed, Tesla still has to manage a complex worldwide model in its supply chain and sales. Combined with a stock price on the US exchange that keeps coming down amid Musk-related boycotts and tariff announcements, there is no certainty this will be easy.

In a nutshell: what possible effects?

First predictions for the impact on the US automotive market are as follow:

- Sales Decline: Analysts anticipate a reduction in US light-vehicle sales to between 14.5 and 15 million units annually in the coming years, down from 16.03 million units in 2024. This decline is attributed to increased vehicle prices resulting from the tariffs.

- Production Disruptions: The tariffs are expected to disrupt North American vehicle production by mid-April, potentially reducing output by approximately 20,000 cars per day, equating to about 30% of production.

At a glance: Car manufacturer first responses

- General Motors (GM): GM is shifting more production of its Chevrolet Silverado and GMC Sierra trucks to its Fort Wayne, Indiana plant, potentially creating 225 to 250 new jobs. This strategy aims to lower tariff-related costs and maintain competitive pricing

- Nissan: Nissan reversed its plan to reduce shifts, opting to continue two shifts at its Smyrna, Tennessee plant to enhance domestic output

- Ford: Ford launched the “From America, For America” promotion, offering all customers employee-level discounts on eligible 2024 and 2025 Ford and Lincoln models until June 3. This move aims to maintain customer interest and counter rising prices due to the tariffs.

- Volkswagen (VW): VW announced it will introduce an “import fee” on vehicles shipped to the U.S. in response to the new tariffs. The company has paused rail deliveries from Mexico and will temporarily hold vehicles arriving from Europe at U.S. ports.

- Volvo: Volvo plans to expand production at its South Carolina plant to circumvent tariffs and may add another model to US output. CEO Håkan Samuelsson emphasized the importance of localizing production amid increasing geopolitical complexity.

Conclusion

The sweeping tariffs introduced by the US government mark a pivotal shift in global trade dynamics, particularly for the automotive industry. With stacked duties impacting everything from steel and aluminium to finished vehicles and critical semiconductor components, automakers are facing unprecedented pressure on multiple fronts—profit margins, production logistics, and market competitiveness. These ripple effects extend beyond traditional manufacturing to affect machine vision suppliers, tech firms, and the broader global supply chain.

While US-based manufacturers like Ford and Tesla may appear better positioned to weather the storm, their complex international supply chains mean they are far from immune. For foreign automakers, the pressure to localize production in the US is intensifying, leading to potential job creation stateside but also raising long-term questions about the viability of global operations in an increasingly protectionist environment.